China’s trade surplus hits $1tn for first time despite Trump’s tariffs – business live | Business

Introduction: China’s trade surplus hits $1tn

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

China’s annual trade surplus has exceeded $1tn for the first time, as the manufacturing powerhouse shrugged off the impact of Donald Trump’s trade war.

New trade data today shows that Chinese factories swelled their sales to non-US markets this year, making up from a sharp drop in shipments to the US.

In November, China’s exports grew 5.9% year-on-year, customs data shows. That reverses a 1.1% contraction in October, and beats analyst forecasts.

And for the first 11 months of the year, China’s annual trade surplus (the difference between what it exported and imported), rose above the $1tn mark for the time (by my maths it was over $1.07tn).

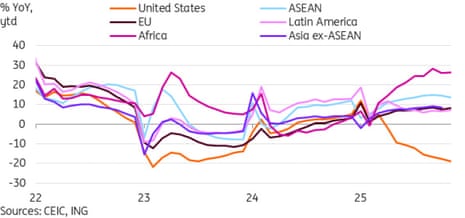

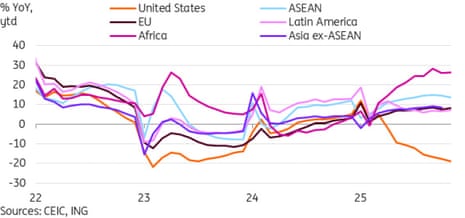

While exports to the US have slowed this year, due to the trade tensions between Washington and Beijing, China has turned to other markets – such as Europe.

Lynn Song, ING’s chief economist for Greater China, explains:

November exports to the US were down -28.6% YoY, a three-month low, bringing the year-to-date growth to -18.9% YoY. It’s likely that November exports have yet to fully reflect the tariff cut, which should feed through in the coming months.

Also, the frontloading effect as US importers ramped up purchases ahead of tariffs will act as a headwind on trade in the coming months. Instead of the US, the beat in November’s data came from an acceleration of exports to the EU.

By product, Song adds, familiar categories continued to see the strongest growth; ships (26.8%), semiconductors (24.7%), and autos (16.7%).

China’s rare earth exports jumped 26.5% month-on-month in November, Reuters reports – that’s the first full month after Xi and Trump agreed to speed up shipment of the critical minerals from the world’s largest refiner.

Soya bean imports are also poised for their best-ever year, as Chinese buyers, who had shunned US purchases for the majority of this year, stepped up purchases from American growers in addition to large purchases from Latin America.

The agenda

Key events

Italy’s Meloni joins calls to scrap EU 2035 ban on petrol cars

Lisa O’Carroll

The Italian prime minister Giorgia Meloni has joined German chancellor Friderich Merz’s call for the EU’s 2035 ban on the production of new petrol cars to be scrapped.

She wants the deadline to be softened, allowing the continued sale of plug-in hybrid cars.

In a letter, also signed by the leaders of Poland, Czechia, Slovakia, Hungary and Bulgaria, Meloni argues a hard cut off date will kill off the European car industry, which is struggling against cheaper Chinese rivals to sell and produce cheap electric cars.

The letter warns:

“There is nothing green about an industrial wasteland,”

The European Commission is due on Wednesday to pronounce on the 2035 deadline, a deadline only introduced three years ago, giving the car industry three years to develop electric vehicles.

The EC has already said the letter sent by Merz 10 days ago calling for the 2035 deadline to be softened was received positively, indicating it will soften the deadline.

The Greens have said any roll back on 2035 would be a “gutting” of the Green Deal created by European Commission president Ursula von der Leyen and signed off in 2022. They are backed by Swedish car makers Volvo and Polestar and the charging industry.

Meloni and leaders of the other countries are calling for “even after 2035, the role of plug-in hybrid electric vehicles (PHEVs) and fuel cell technology and introduces the recognition of range-extender electric vehicles (ERVs)” to be allowed.

There’s a very calm start to trading in London this morning.

The FTSE 100 index of blue-chip shares has gained just one point, or 0.01%, to 9,668 points.

Consumer goods maker Unilever are the top faller, down 3.7%, after spinning off its ice-cream business (The Magnum Ice Cream Company (TMICC) is up 1.1% in its trading debut).

[Unilever’s fall is basically for technical reasons; it has now lost Magnum’s profits, which were around 10% of Unilever’s full-year earnings in 2024.

Unilever is planning to conduct a share consolidation today, to “maintain comparability” beween its share price and per share metrics (including earnings per share and dividends per share) before and after the demerger. That should take place after the market closes today.]

Aarin Chiekrie, equity analyst at Hargreaves Lansdown, says:

The separation makes TMICC the largest ice cream business in the world, with iconic brands like Magnum, Ben & Jerry’s, Wall’s and Cornetto in its portfolio.

It’s already scooped up a 21% share of global ice cream sales, nearly double that of its largest competitor, Froneri. The global ice cream market is forecast to grow by 3-4% annually until at least 2029. TMICC is targeting growth slightly ahead of this pace, up to 5% annually, driven by increased marketing investment, improved distribution channels and market share gains.

There’s a kerfuffle in the mining industry today, where investors have blocked a controversial multi-million pound bonus.

Mning giant Anglo American has dropped plans to seek approval to change its executive directors’ bonus awards, if its planned merger with Canada’s Teck Resources was completed.

Anglo had proposed amending its long-term bonus schemes so that if the merger was completed various executives, including CEO Duncan Wanblad, would be guaranteed a minimum of 62.5% of the shares that can ultimately vest through the incentive plan.

The Times has calculated that at current share prices, that would mean a bonus worth about £8.5m for Wanblad.

But following a backlash from the City, Anglo has withdrawn this proposal from the agenda of the General Meeting of shareholders to be held tomorrow afternoon to vote on whether to approve the Teck takeover.

Anglo insisted this morning it had “engaged extensively with Shareholders” over this proposal adding:

Whilst Shareholders with whom we consulted strongly supported the objectives of Resolution 2 and appreciated the very specific context for the Proposals, they nonetheless raised a number of concerns when considering more general remuneration principles.

Anglo American strongly believes that the proposed amendment represents the most practical way to support the Merger process and the principles and objectives set out in the Circular but, having reflected carefully on Shareholders’ concerns, has therefore decided to withdraw Resolution 2 from the agenda of the General Meeting.

Anglo adds that its remuneration committee will develop an updated Directors’ remuneration policy, so we may not have heard the last about this…

Over in Germany, industrial production rose much more than anticipated last month.

Industrial output increased by 1.8% month-on-month in October, data firm Destatis reported, up from 1.1% in September.

Destatis says:

Within the industrial sector, an increase was recorded across all three main groups: the production of capital goods and consumer goods each rose by 2.1%, and the production of intermediate goods by 0.6%. Outside of the industrial sector, energy production increased by 1.4%.

This pick-up could help Germany’s economy to return to growth in the final quarter of 2025.

China’s yuan-denominated exports to Russia fell for an eighth straight month in November, today’s customs data shows.

Reuters has the details:

Shipments to Russia dropped to 67.71bn yuan (£7.2bn) in November, 5.1% less than the same month last year. Exports plunged 22% in October.

Imports from Russia rose 3.2% on-year, accelerating from October’s 2.5% growth.

Exports to Russia in the January-November period were down 11.2% from the same period last year.

Today’s trade data also shows China’s exports to the European Union grew an annual rate of 14.8% last month.

That could intensify concerns within Europe that China is dumping products in their markets, to avoid tariffs at the US border.

Yesterday, French president Emmanuel Macron said he has threatened China with tariffs if Beijing fails to take steps to reduce its massive trade surplus with the EU.

After returning from a state visit to China, Macron told business daily Les Echos:

I told them that if they don’t react, we Europeans will be forced to take strong measures in the coming months”

Introduction: China’s trade surplus hits $1tn

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

China’s annual trade surplus has exceeded $1tn for the first time, as the manufacturing powerhouse shrugged off the impact of Donald Trump’s trade war.

New trade data today shows that Chinese factories swelled their sales to non-US markets this year, making up from a sharp drop in shipments to the US.

In November, China’s exports grew 5.9% year-on-year, customs data shows. That reverses a 1.1% contraction in October, and beats analyst forecasts.

And for the first 11 months of the year, China’s annual trade surplus (the difference between what it exported and imported), rose above the $1tn mark for the time (by my maths it was over $1.07tn).

While exports to the US have slowed this year, due to the trade tensions between Washington and Beijing, China has turned to other markets – such as Europe.

Lynn Song, ING’s chief economist for Greater China, explains:

November exports to the US were down -28.6% YoY, a three-month low, bringing the year-to-date growth to -18.9% YoY. It’s likely that November exports have yet to fully reflect the tariff cut, which should feed through in the coming months.

Also, the frontloading effect as US importers ramped up purchases ahead of tariffs will act as a headwind on trade in the coming months. Instead of the US, the beat in November’s data came from an acceleration of exports to the EU.

By product, Song adds, familiar categories continued to see the strongest growth; ships (26.8%), semiconductors (24.7%), and autos (16.7%).

China’s rare earth exports jumped 26.5% month-on-month in November, Reuters reports – that’s the first full month after Xi and Trump agreed to speed up shipment of the critical minerals from the world’s largest refiner.

Soya bean imports are also poised for their best-ever year, as Chinese buyers, who had shunned US purchases for the majority of this year, stepped up purchases from American growers in addition to large purchases from Latin America.