UK manufacturing downturn continues as new orders slide; Trump’s attack on Fed is ‘a serious danger’ – business live | Business

UK manufacturing downturn continues as new orders and new export business fall

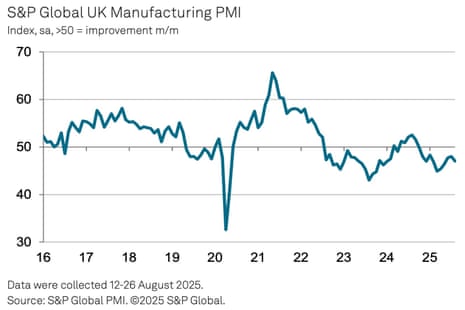

Ouch! The UK manufacturing sector shrank again last month, as factories were hit by weaker demand at home and abroad.

The latest monthly poll of purchasing managers across Britain’s manufacturing sector found that new orders and new export business both fell at quicker rates in August, leading to another drop in production volumes.

This pulled the S&P Global UK Manufacturing Purchasing Managers’ Index down to 47.0 in August, from July’s six-month high of 48.0. It’s the 11th month in a row in which the PMI has come in below the 50-point mark showing stagnation.

UK factories blamed lower new work inflows to “subdued client confidence”, citing tariff uncertainties, and cost increases due to the rise in the minimum wage and employer national insurance rates.

Rob Dobson, director at S&P Global Market Intelligence, says:

“Production volumes are still showing resilience in the face of global geopolitical uncertainty and US tariff policies, with both July and August having seen only slight contractions that were milder than those suffered earlier in the year. Business confidence has also lifted to a sixmonth high, reflecting hopes that the trading environment is starting to settle down.

However, August also saw a steep drop in UK manufacturers’ new orders, with total order books and overseas demand both falling at some of the fastest rates seen over the past two years. Weak market conditions, US tariffs and downbeat client confidence all contributed to the dearth of new contract wins. Job cuts were also reported for a tenth successive month, with factory headcounts dropping to one of the greatest extents postpandemic.

The outlook for the sector therefore clearly remains very uncertain. With manufacturers fearing that possible government policy decisions, including potential tax increases, could further hurt their competitiveness in domestic and export markets, the upcoming Budget will likely prove very important in guiding business confidence about the year ahead.

Key events

The early rally in the London stock market has rather fizzled out.

Although defence stocks are still up, following the UK’s £10bn warship deal with Norway, the wider FTSE 100 index is now flat.

Even so, investors have enjoyed a solid rally since the turmoil triggered by Donald Trump’s trade war faded back in the spring.

Tom Stevenson, investment director at Fidelity International, explains:

“Bar a September stock market wobble – and history shows they sometimes happen at this time of year – investors will be celebrating a powerful summer rally by the time of next week’s St Leger Day horse race in Doncaster.

“That’s the second part of the old stock market adage that tells investors to ‘sell in May and go away, don’t come back ‘til St Leger’s Day’. It often fails to deliver – unsurprising, given the tendency of markets to rise over time – but it rarely falls over as spectacularly as it has this year.

“Since Donald Trump’s U-turn on tariffs in early April – when he paused levies for 90 days a week after imposing them – shares have soared. The S&P 500 is up from a low of below 5,000 to 6,500 last week. Here, the FTSE 100 has risen from 7,700 to 9,300. While in Japan, the Nikkei is up from 31,000 to 43,000 today.

In the automobile sector, Tesla is still proving popular in Norway.

While sales in other European countries have wilted this year, Teslas made up more than a fifth of new car sales in Norway in August.

The Norwegian Road Federation has reported that Tesla models were close to 22% of new car sales in August, with electric cars as a whole accounting for 97% of new passenger vehicle registrations.

But other markets are tougher to crack. Data from France today showed that registrations of new Tesla cars fell 47.3% in August versus the same month in 2024.

Tesla registrations fell more than 84% in Sweden – where electric vehicle sales were flat and the market overall was up 6% – and dropped 42% in Denmark.

UK bond yields rise after Downing Street reshuffle

Britain’s long-term borrowing costs are inching closer to their highest level since 1998 as the City digests a shake-up at Number 10 Downing Street.

The yield, or interest rate, on UK 30-year bonds has risen to 5.64% this morning, the highest since the 27-year high set in April.

Yields measure the cost of borrowing, and this increase threatens to eat into chancellor Rachel Reeves’s fiscal headroom as she draws up the autumn budget.

The reshuffle will see Darren Jones, the chief secretary to the Treasury, move to a new senior role in Downing Street. The former Bank of England deputy governor Minouche Shafik will become Starmer’s chief economic adviser.

The shake-up is meant to improve the delivery of Starmer’s policy goals.

But investos also see it as a signal that the government will issue more debt than previously expected, suggests Simon French of investment bank Panmure Liberum:

Posting on X, French says:

Yield spread between what UK 10Y paper trading at – and max from the rest of the G7 – is now at +50bp. That’s the highest on record and takes out the Spring Statement high. New economic team needs to show No.10 gets this dynamic, and backs their Chancellor.

The immediate market reaction is not exactly a vote of confidence on these moves. Markets seeing it as a signal of more Gilt issuance/ inflation to come. Yield spread between what UK 10Y paper trading at – and max from the rest of the G7 – is now at +50bp. That’s the highest on… https://t.co/CzQTph0LWB pic.twitter.com/GP1XISqT7U

— Simon French (@Frencheconomics) September 1, 2025

Long-dated eurozone government bond yields have also risen today, as traders anticipate the likely collapse of the French government next week if it loses a confidence vote.

Home buyer mortgage approvals rise to six-month high

The number of mortgage approvals made to home buyers jumped to a six-month high in July, according to Bank of England figures.

Some 65,352 mortgage approvals for house purchases were recorded in July, which is the highest total since January when 65,775 home loans were approved.

However, there was also a drop in the value of new mortgages approved in July – it fell by £900m to £4.5bn, having jumped to £5.4bn in June.

The Bank also reports that the ‘effective’ interest rate on new mortgages decreased for the fifth consecutive month, to 4.28% in July from 4.34% in June. However, the rate on the outstanding stock of mortgages remained at 3.88%.

Donald Trump is trying to send a clear message to the Federal Reserve by attempting to fire Lisa Cook, says Enrique Diaz-Alvarez, chief economist at global financial services firm Ebury

“Lisa Cook’s attempted firing by Trump is likely to be a long legal process. While the short term impact is limited, the message being sent to other Fed governors is unmistakable.

“Long term rates are the key for Trump, as they drive mortgage rates and hence the housing markets, and these remain stubbornly high even as expectations for rate cuts grow.”

Lagarde warns Trump’s attack on Federal Reserve is ‘a serious danger’

The head of the European Central Bank has warned that the global economy could be rocked by Donald Trump’s shake-up of America’s central bank.

Steps by US President Donald Trump to remove Federal Reserve Chairman Jerome Powell or Fed governor Lisa Cook would represent a “very serious danger for the US economy and the world economy”, said ECB president Christine Lagarde said today.

Lagarde told Radio Classique:

“If U.S. monetary policy were no longer independent and instead dependent on the dictates of this or that person, then I believe that the effect on the balance of the American economy could, as a result of the effects this would have around the world, be very worrying, because it is the largest economy in the world.”

Last week, lawyers representing Cook accused Trump of using unconfirmed allegations of mortgage fraud as his “weapon of choice” to attack the Federal Reserve’s independence, after the president announced he was firing her.

Lagarde also told Radio Classique that a ruling on Friday by a US appeals court that most of Donald Trump’s tariffs were illegal were adding a “further layer of uncertainty” to the global economic outlook.

Trump has repeatedly blasted Powell for the Fed’s failure to cut US interest rates this year, and is expected to appoint a successor with a more dovish approach.

Eurozone unemployment dips to record low of 6.2%

Unemployment across the eurozone has dropped to its record low this summer.

New data from statistics body Eurostat show that euro area seasonally adjusted unemployment rate dropped to 6.2% in July, down from 6.3% in June 2025 and from 6.4% in July 2024.

Eurostat estimates that there were 13.025m people unemployed in the European Union, including 10.8m in the euro area.

In July, unemployment decreased by 165,000 in the EU and by 170,000 in the euro area.

Analysts at ING say:

Falling unemployment suggests that the eurozone economy remains resilient in the face of global uncertainty.

Modest economic growth seems realistic for the coming quarters, as the strong labour market should aid some domestic recovery

UK Manufacturing PMI (AUG’25)

Final: 47.0

Previous: 48.0

Consensus (Flash Estimate): 47.3Key Points:

• New orders contract at fastest pace in 4 months and to one of greatest extents seen in 2 years.

• Another month of job losses, driven by tariff uncertainty and higher NI/MW… pic.twitter.com/JMSspIHY7Q— Interpretiv (@InterpretivUK) September 1, 2025

Manufacturing supply chains also remained stretched in August.

Today’s PMI report flags that the average wait to receive raw materials lengthened last month, due to a combination of shipping delays, vendor capacity issues, transportation re-routing to avoid the Red Sea and global material shortages.

UK factories also reported they cut jobs for the tenth consecutive month.

S&P Global says:

Lower employment was linked to weaker intakes of new work, tariff uncertainties and rising labour costs (particularly the ongoing impact of higher minimum wages and employer NICs).